FTMO is a well-known prop trading platform that provides an opportunity for traders to raise capital for trading in the financial markets. Whether you are an experienced trader looking for a growth opportunity or someone who wants to trade with larger funds, FTMO can be the ideal solution.

But how does it all work and what to expect from this platform? Let’s take a look at the key aspects and answer the most common questions anyone interested in FTMO might ask.

FTMO Review – Article of Contents

How does the FTMO platform work?

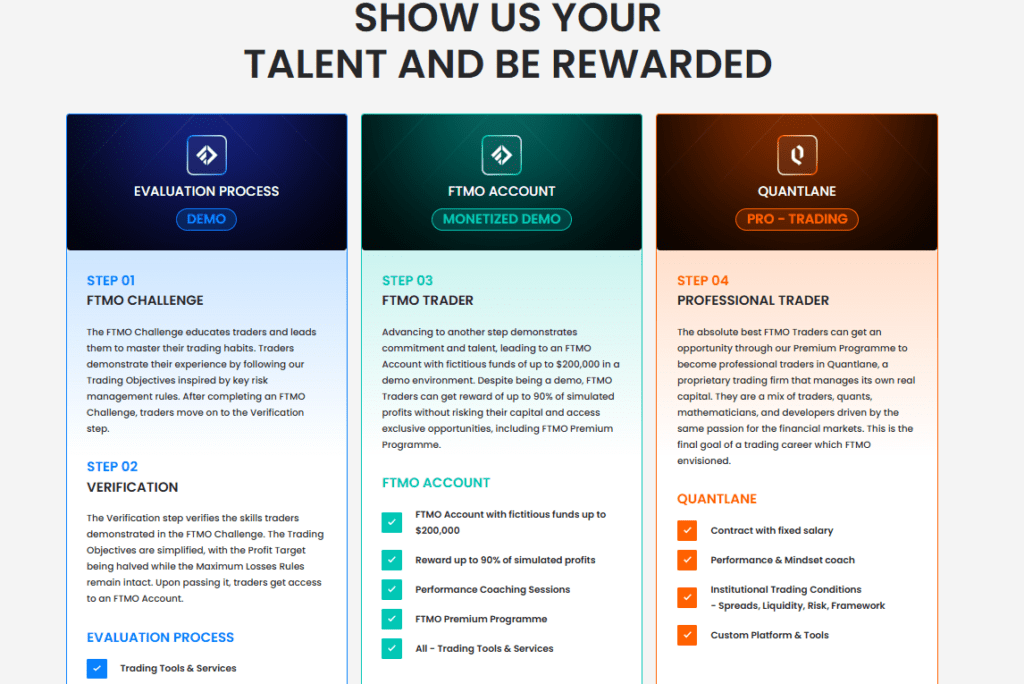

The platform offers a two-part selection process, which is used to verify the skills of traders before allocating them capital for trading. This process consists of the FTMO Challenge and Verification.

FTMO Challenge: The goal of the first phase is to achieve a 10% profit within 30 days, where the trader must maintain a maximum daily loss of 5% and a total loss of 10% of the initial capital. If the trader meets these requirements, he/she will proceed to the next phase.

Verification: In the second phase, the trader is given 60 days to achieve a 5% profit and comply with similar rules regarding losses. Upon successful completion of both phases, the trader will receive capital in a real trading account.

The entire process is designed to verify not only profitability but also discipline and the ability to manage risk – key skills for success in trading.

Also read: yPredict – Revolutionary cryptocurrency prediction platform

What is unique about FTMO?

Great conditions for traders:

Profit Split up to 80%: The platform offers one of the most favorable profit splits in the industry. Traders can get up to 80% of the profits and the company only takes 20%. This is a very attractive offer, especially compared to competitors where the trader’s share tends to be lower.

Account scalability: If a trader demonstrates stable profitability, he can increase his account size up to $2 million. This option is ideal for ambitious traders who want to grow and raise more capital.

Flexibility:

Diverse trading assets: The platform offers a wide selection of trading assets – from forex to commodities, stocks, and indices. This flexibility is important for traders who want to focus on specific markets or strategies.

Trading Conditions: Traders can trade on MetaTrader 4 and 5, which are some of the most common and advanced trading platforms on the market.

FTMO Review – What are the costs and fees?

When you decide to join the platform, you will have to pay an entry fee for the FTMO Challenge, which varies depending on the size of the capital you want to trade with.

Entry Fees:

For account size

- EUR 10,000, the entry fee is EUR 155.

- EUR 25,000 is an entry fee of EUR 250.

- 50 000 EUR you will pay 400 EUR.

- EUR 100 000 is a fee of EUR 600.

- For EUR 200 000 you will pay EUR 1 000.

It is important to note that this fee is a one-off and refundable if you are successful in both phases (Challenge and Verification). Once you successfully complete these phases, the fee is refundable, which is one of the advantages of the platform.

While this may seem like a high amount at first glance, if you manage to succeed in the Challenge and Verification, you will gain access to real capital trading without the need for a deposit of your own, which is very convenient for many traders.

Don’t miss: BITmarkets.com: A review of the crypto exchange that is rewriting the rules of the game

What are the trading conditions on FTMO?

Risk management is a key part of trading on FTMO. Traders must adhere to strict rules regarding maximum daily and total losses:

Maximum daily loss: 5%.

Maximum total loss: 10%.

These limits are set to ensure that the trader does not deplete the account too quickly and focuses on long-term profitability.

Focus on performance analysis: The platform provides traders with tools to analyze their performance, including detailed statistics and reports, allowing traders to continuously improve.

What are traders saying about FTMO?

Traders who have completed the FTMO Challenge have mostly positive feedback. They greatly appreciate:

Favorable terms: Profit sharing (up to 80%) is exceptional compared to competitors.

Fair evaluation process: FTMO is considered a trustworthy platform that provides a level playing field for all traders.

Support and education: The platform offers a wide range of support in the form of analytical tools, economic calendar, personal coaches and even psychological help for trading.

Some negative comments have been made about the strict rules regarding losses, but this is part of the reason why FTMO excels – it emphasizes on traders being disciplined and responsible.

Read also: Coinbase – review of the cryptocurrency exchange

Benefits of the FTMO platform

1. High profit split (up to 80%)

One of the main attractions of the platform is the high profit share that traders can get. Up to 80% of profits go directly to the trader, which is quite exceptional among prop trading platforms. This system motivates the best results and is fair at the same time.

2. Account scalability

The platform allows traders to increase the account size up to $2 million if they demonstrate long-term profitability. This flexible approach gives traders the chance to grow and trade with more capital without having to start with their own capital.

3. Diversity of trading assets

Traders can trade a wide range of assets, from forex to commodities, stock indices and cryptocurrencies. This allows each trader to choose the markets that suit them.

4. Support and tools for improvement

The platform provides traders with comprehensive support in the form of analytical tools, personal coaches and access to trading education. This is useful not only for beginners but also for experienced traders who want to continuously improve their performance.

5. A fair selection process

The FTMO Challenge and Verification process is well set up, fair and transparent. Traders have the opportunity to showcase their abilities while going through a selection process that focuses on actual ability, not just chance or luck.

Disadvantages of the FTMO platform

1. High entry fees

While the profit split system is convenient, the entry fees for the FTMO Challenge can be quite high. Accounts with a value of $100,000 are charged $540, which can be a barrier for some traders, especially if they are at the beginning of their career.

2. Strict risk management rules

Rules regarding maximum losses may be too restrictive for some traders. The maximum daily loss is set at 5% and the total loss at 10%, which means that traders have to be very careful and disciplined. If they fail to keep losses within these limits, they will not pass the selection process.

3. High performance requirements

Although the FTMO process is designed for experienced traders, some may feel that the requirements to successfully complete the Challenge and Verificationare too demanding. A trader must achieve 10% profit in the first phase and 5% in the second phase within a specific time frame, which may be difficult for some.

4. Risk of loss of capital if unsuccessful

If a trader fails both phases of the selection process, he loses the entry fee. Even if it is an investment in the ability to trade the company’s capital, there is still a risk of failing and losing the money you initially invested.

5. Focusing only on experienced traders

FTMO is not ideal for complete beginners because the evaluation process is geared towards traders with some experience. Newbies who are just getting started with trading might feel lost if they don’t have a strong trading strategy and the right approach to risk management.

FTMO Review – Conclusion

The platform is ideal for traders who are looking for great trading conditions and growth opportunities. With a fair rating process, high profit split and account scaling options, it’s a great solution for anyone with the necessary experience and discipline. If you are ready to take on the challenge, you can make a lot of money on this unique platform without having to invest your own capital.

If you are a trader with experience and a clearly defined strategy, FTMO can provide you with the opportunity to grow and trade with higher amounts. But remember that success in Challenge and Verification requires careful risk management and the ability to focus on long-term goals, not quick profits.

FTMO is therefore ideal for serious and ambitious traders who are interested in developing professionally and earning big money.